Credit Freeze Removal Request Free

A person wishing to ask a credit reporting agency to remove a credit freeze from their account can use this Credit Freeze Removal Request.

Template Overview

Template Overview

A person wishing to ask a credit reporting agency to remove a credit freeze from their account can use this Credit Freeze Removal Request.

A credit freeze is an essential tool when wanting to restrict access to a person's credit report. By limiting this access, it makes significantly more challenging for identity thieves to open further lines of credit in the person's name. However, it also affects the person from having access to their own credit. But if a person wishes to reaccess their credit trough a Credit Freeze Request Letter by getting a loan, credit card, or mortgage, they can avail themselves using this Credit Freeze Removal Request Letter and ask their credit reporting agency to unfreeze their credit.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

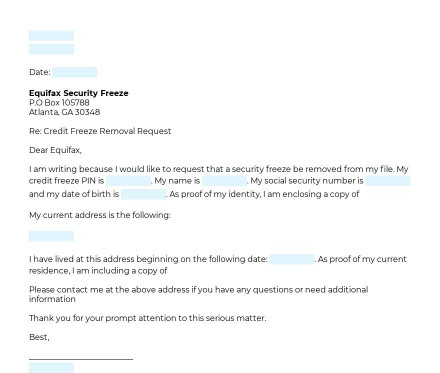

The person filling the document will have to ask that their credit reporting bureau remove a credit freeze from their account. This action is also known as a credit thaw. Firstly, the person will have to fill down the identifying information of themselves, as well as the PIN, which they should have received from their credit reporting agency when they placed the credit freeze on their account. Later, the document will require to add proof of their identity, such as a copy of passport or other official identity documentation. The document will also ask for proof of their address, using copies of utility bills, bank statements, or other documentation proving their residence.

A completed document should be signed and dated and then sent, along with the necessary proof and documentation. We recommend using certified mail in order to make sure that the request will not disappear. Once a credit reporting agency receives a request to remove a credit freeze, it generally takes several business days for the credit thaw to happen.

Applicable law

Applicable law

Both state and federal laws govern identity theft and credit reporting. According to the Economic Growth, Regulatory Relief, and Consumer Protection Act, a federal law passed in 2018, it is unlawful for any credit reporting agency charge for a credit freeze or thaw, regardless of which state the person making the request lives in.

Ready to build your document from this template?

Please wait

Please wait