Debt Collection Cease and Desist Letter Free

This document is a formal request sent to the recipient to stop ("cease") and discontinue ("desist") his actions.

Template Overview

Template Overview

A Cease and Desist letter is used in cases when an individual or business is informed that his behavior is unwelcome and/or illegal. This is a formal request sent to the recipient to stop ("cease") and discontinue ("desist") his actions. If the recipient does not intend to comply with these requirements, the sender must be prepared to proceed legally to stop the behavior that harms or interferings with the sender's rights and abilities to execute the business.

Individuals, who have credit debts or other loans, as well as mortgages, receive unreasonable amounts of phone calls, letters, or other notifications from creditors and debt collectors, can use this Cease and Desist letter.

Below are the documents used for various Cease and Desist situations:

- Intellectual Property Cease and Desist letter tailored to demand that some form of intellectual property infringement stop

- Harassment Cease and Desist letter tailored to request that a party stop harassment

- General Purpose Cease and Desist letter that can be used to demand any unwanted behavior to stop

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

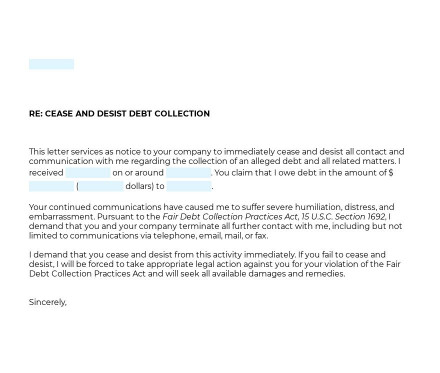

A Cease and Desist letter consists of:

- Sender: an individual or company requesting the suspension of the behavior

- Recipient: an individual or business who is being asked to stop a behavior

- A detailed description of the misconduct and its consequences

- A warning that legal action will be taken if the behavior won't stop

- A deadline for the legal action to be taken

The main advantage of using this Cease and Desist letter is that it is suitable for sending to aggressive and unscrupulous debt collectors and creditors. The letter requires the debt collector to suspend his repeated contact with the sender because he violates the Fair Debt Collection Practises Act.

Once completed, it should be sent through certified mail to individuals or businesses whose behavior is not appropriate.

Applicable law

Applicable law

No laws are governing what must be described in a Cease and Desist letter. However, it is recommended that a Cease and Desist includes a detailed description of the offending behavior and an apparent demand that the behavior stop or else legal action will be taken. Besides, Cease and Desist letters are often used in court as proof that the Defendant was put on notice about their offending behavior. So make sure that your message is as detailed as it can be.

The Fair Debt Collection Practices Act includes the Cease and Desist letter, as this letter is a formal request to stop the inappropriate debt collection behavior. This Act is a consumer protection law that establishes protection from abusive debt collection practices such as sending excessive amounts of mail or making phone calls outside of standard business hours.

Ready to build your document from this template?

Please wait

Please wait