Debt Settlement Agreement Free

When a Debtor (the person who owes money) or a Creditor (the person who is owed money) wants to resolve an outstanding debt that is owed, a Debt Settlement Agreement can be used.

Template Overview

Template Overview

When a Debtor (the person who owes money) or a Creditor (the person who is owed money) wants to resolve an outstanding debt that is owed, a Debt Settlement Agreement can be used. The document is used when the Debtor is unable to pay the full amount of the debt that they owe to the Creditor.

In the contract, the parties can negotiate and agree on a lower amount of money that the Debtor will have to pay to cover the debt. Therefore, the Debtor gets a chance to repay the debt, and the creditor includes part of his losses. This Agreement can be used to put in writing the terms of the agreement that the Parties have negotiated, or it can be used for one Party to propose to the other Party the terms of resolving the outstanding debt.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

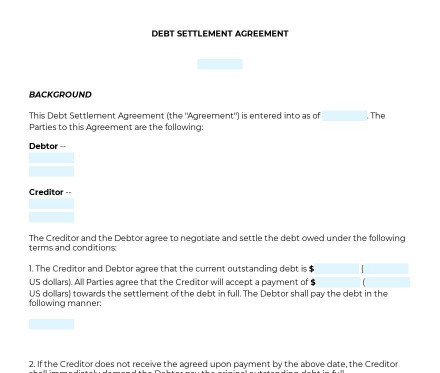

The document contains all the information needed to settle the debt between the creditor and the debtor. It also includes contact details of the parties, their addresses, and, if applicable, the names of their legal representatives.

The document also sets out the main terms of the agreement between parties, the initial amount owed, the new amount the debtor will pay to the creditor, the manner of repayment, and the final date for payment. Other details of the agreement, as well as confidentiality agreements, can also be included in the document.

A completed document should be printed and signed by both parties and kept for future reference.

Applicable law

Applicable law

In the US, state-specific laws govern Debt Settlement Agreements and cover debt principles.

Ready to build your document from this template?

Please wait

Please wait