Guaranty Agreement Free

Parties wishing to validate the agreement may use this document. The creditor can use this contract to define the terms of the credit extension. And the debtor or guarantor may use the document as a written offer to the creditor.

Template Overview

Template Overview

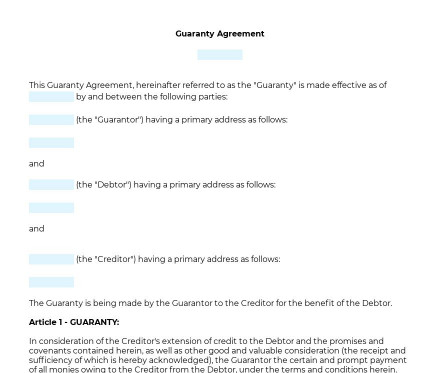

You can use the Guaranty Agreement to enter into an agreement that secures someone else's loan or debt. Thus, the party guaranteeing the loan or debt is agreeing to pay the amount owed if the borrower defaults. Only one party, the guarantor signs the Guaranty Agreement, but the entire agreement is made between three parties: the creditor, extending the credit, the debtor and the guarantor.

Guaranty Agreements is known for its simplicity as it only provides necessary information about parties' identities, their contact information, which debt is guaranteed, and other additional terms.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

Parties wishing to validate the agreement may use this document. The creditor can use this contract to define the terms of the credit extension. And the debtor or guarantor may use the document as a written offer to a creditor.

Note that the parties filing the document should be extra careful, as it is a matter of money. Once completed, the guarantor should print the document and sign it. We recommend keeping copies in case any future disputes arise.

Applicable law

Applicable law

State-specific laws in each jurisdiction cover Guaranty Agreements.

Ready to build your document from this template?

Please wait

Please wait