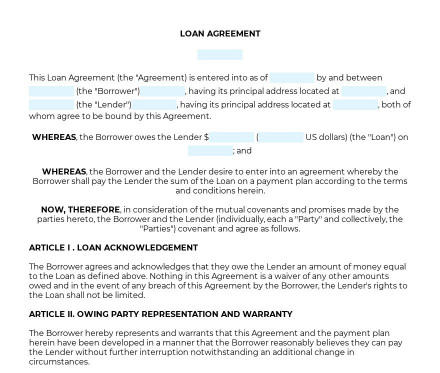

Loan Agreement Free

A Loan Agreement is a document that acts as a written assurance from a lender to loan the money to someone in exchange for the borrower's promise to repay the money lent.

Template Overview

Template Overview

A Loan Agreement is a document that acts as a written assurance from a lender to loan the money to someone in exchange for the borrower's promise to repay the money lent. The note serves as a legal document that is enforceable in court creating obligations on the parts of both the borrower and the lender.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

In the Agreement, parties outline all the terms and details of the loan, specify the names and addresses and the amount being borrowed. Also, it is required to include how often payments will be made.

If the lender and the borrower decide to change the terms of the Loan Agreement, use an Amendment to Agreement form. Once the loan has been fully repaid, complete a Release of Loan Agreement form. (ideti linka)

Applicable law

Applicable law

Loan Agreements are governed by Article III of the Uniform Commercial Code (the "UCC").

There are a number of essential elements that must be present in order for your Loan Agreement to be enforceable in a court of law.

- A Loan Agreement must be in writing so that a court can refer to the written record.

- The Agreement must be a promise to pay money.

- The Agreement must indicate a specific amount of money that will be paid. This does not apply to any interest that may be required. If an Agreement specifies an interest rate but does not include a dollar amount, it is still valid.

- The borrower and lender must both sign the Agreement

Ready to build your document from this template?

Please wait

Please wait