Notification of Fraudulent Tax Filing Free

A victim of identity theft whose personal information has been used in connection with tax fraud can use this Notification of Fraudulent Tax Filing.

Template Overview

Template Overview

A victim of identity theft whose personal information has been used in connection with tax fraud can use this Notification of Fraudulent Tax Filing.

Once the victim becomes aware that tax fraud has occurred, they generally first notify the Internal Revenue Service (IRS) by phone by calling the IRS Tax Fraud Hotline at 1(800) 829-0433 to report that the fraud has occurred. This letter is a follow up on that initial phone call, and it contributes further evidence and information about the circumstances surrounding identity theft and tax fraud. This letter gives the IRS further notice of the issue and gives written documentation and a paper trail of the victim's efforts to rectify the situation.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

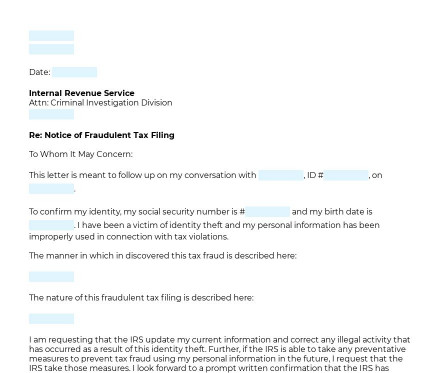

The person filling the document will have to enter the contact information as well as the name and ID # of the IRS customer service agent to whom they spoke and the date the first conversation took place. They can also include their social security number and birthdate to help the IRS confirm their identity.

Once this information is provided, it is also possible to describe the circumstances surrounding the situation, including the nature of the identity theft, how and when they discovered the fraudulent tax filing, and any other details that would help the IRS investigate this issue and confirm that the tax filing was made fraudulently.

A completed document should be sent through verified mail.

Applicable law

Applicable law

Depending on whether federal, state, or city taxes are the subject of this letter, taxes are governed on multiple levels of government, from the federal level down to the local level. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates, and gifts, as well as various fees. These taxes are collected by federal, state, and municipal governments. Therefore, a fraudulent tax filing could create a tax burden with any of these entities.

Ready to build your document from this template?

Please wait

Please wait