Request to Cancel Credit Card Free

A Request to Cancel Credit Card is used when a credit cardholder wants to send a request to a credit card company to cancel their card and the account.

Template Overview

Template Overview

A Request to Cancel Credit Card is used when a credit cardholder wants to send a request to a credit card company to cancel their card and the account. This is a straightforward document that only needs the necessary information for a credit card company to successfully close an account.

Although credit cards can be canceled by a telephone, it is best to send a request to the credit card company in writing to create a formal record. Credit cards are being canceled when no longer needed, or a person wants to deal with his debts, so a written letter is an easy way to send a notification to a credit card company.

Keep in mind that your balance must be zero in order to cancel your credit card successfully. If there is any money left in your account, you'll need to spend or transfer it to cancel your card.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

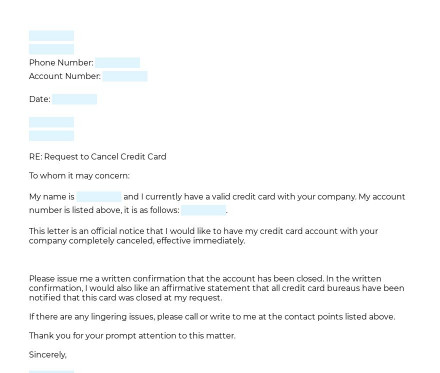

The document can be used in a variety of situations when a credit cardholder wants to cancel the card. This letter contains the owner's identifying information, such as name, address, phone number, and account number. The email can also be added if desired.

You also need to enter a credit card company's information. In the filling process, the owner will have to choose between options, whether the card they wish to cancel has a balance of zero.

Once completed, the document has to be printed and signed in two copies. The account holder should keep the first copy ant the other copy should be sent to the credit card company, most ideally through certified mail.

Applicable law

Applicable law

Credit card cancellation requests must include the applicant's name, surname, and account number so that the company can locate and close the account. Credit cards generally are covered by Federal law through the CARD Act of 2009.

Ready to build your document from this template?

Please wait

Please wait