Response to IRS Unreported Income Notice Free

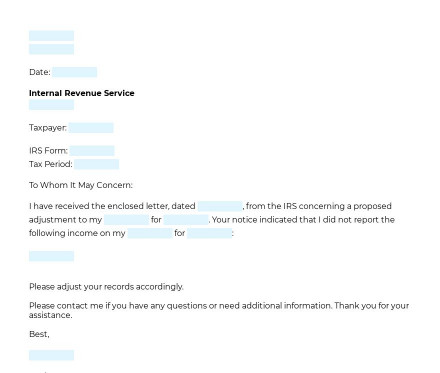

When a taxpayer (an individual or a business) wishes to respond to an IRS suggesting an adjustment to a tax return, particularly to add items of unreported or incorrectly reported income, he can use this Response to IRS Notice Letter.

Template Overview

Template Overview

When a taxpayer (an individual or a business) wishes to respond to an IRS suggesting an adjustment to a tax return, particularly to add items of unreported or incorrectly reported income, he can use this Response to IRS Notice Letter. The letter is considered as a formal document for the taxpayer to communicate with the IRS that they disagree with its adjustments. That means that the taxpayer is able to state why the alteration is in error and what should be done for the IRS to correct their records.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

How to use this template

How to use this template

In the document, the taxpayer has to include all the necessary information to dispute a proposed adjustment by the IRS. He also has to enter identifying details, such as his name, address, and social security number. The document will also require to put the information of why the taxpayer thinks the adjustment is in error.

A completed document should be sent through verified mail, along with copies of any supporting documents.

Applicable law

Applicable law

Depending on whether federal, state, or city taxes are the subject of this letter, taxes are governed by laws on multiple levels of government, from federal to local. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates, and gifts, as well as various fees — these taxes collected by federal, state, and municipal governments. Therefore, an adjustment could be the result of taxes filed with any of these entities.

Ready to build your document from this template?

Please wait

Please wait